Top Bankruptcy Myths Debunked: What Pennsylvania Residents Really Need to Know

When financial stress becomes overwhelming, bankruptcy can feel like a scary or uncertain option. Unfortunately, many Pennsylvanians avoid exploring bankruptcy because of myths that simply aren’t true. At The Law Offices of Jason P. Provinzano, LLC, we help clients throughout PA understand their rights, their options, and how bankruptcy can provide real relief and a fresh start.

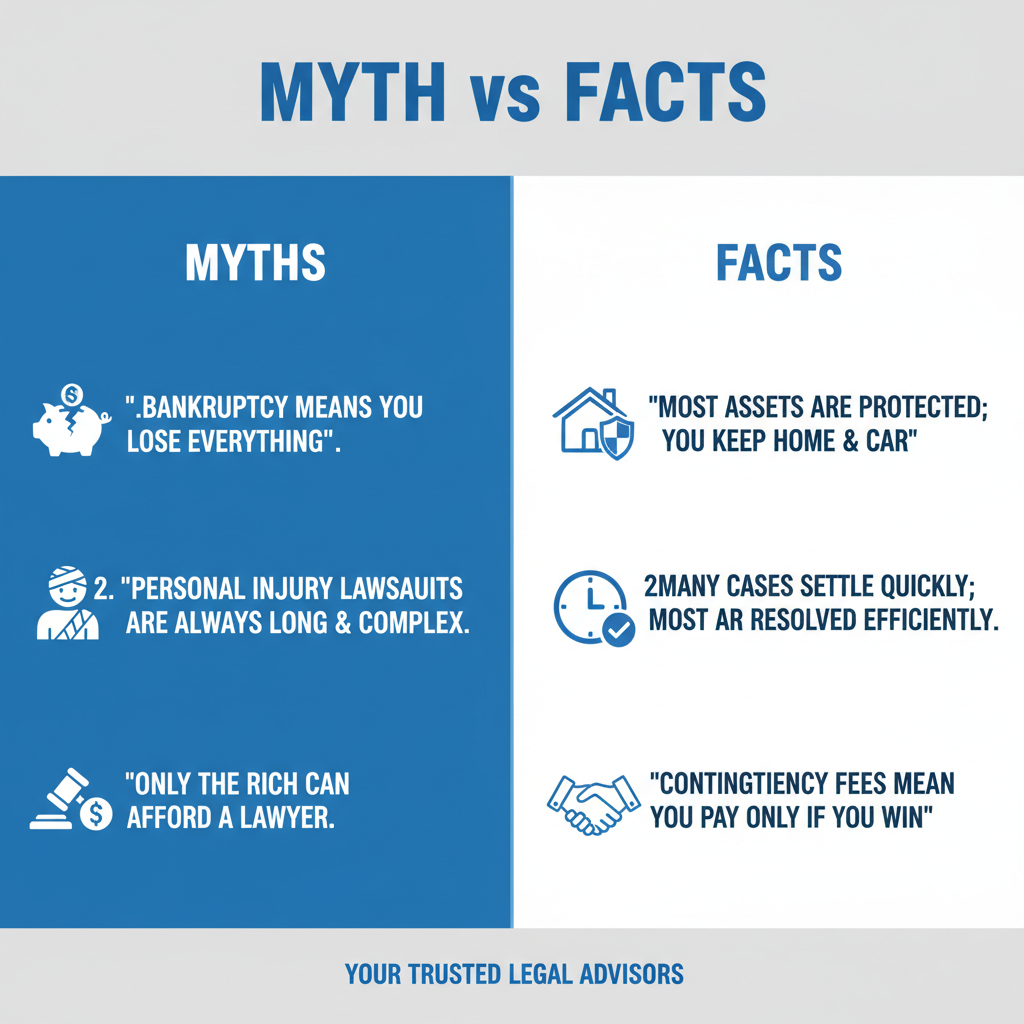

Below, we break down some of the most common bankruptcy myths — and the truth behind them.

Myth #1: “Bankruptcy Will Ruin My Credit for Ten Years.”

The Truth:

While a bankruptcy filing may appear on your credit report for up to ten years, it does not mean you’ll have bad credit for ten years. In fact, many clients in Pennsylvania begin rebuilding their credit within months of filing.

Because bankruptcy wipes out or reorganizes debt, it often improves your debt-to-income ratio, making you more appealing to creditors after your case closes. Many individuals see their credit score rise faster than expected once overwhelming debt is removed.

If your credit is already suffering due to late payments, collections, or high balances, bankruptcy is actually the first step toward rebuilding.

Myth #2: “If I File Bankruptcy, I Will Never Qualify for Another Credit Card or Loan.”

The Truth:

This myth is one of the biggest reasons people avoid filing. The reality? Many people qualify for new credit cards, auto loans, and even mortgages much sooner than they expect.

After bankruptcy, lenders often view you as less risky because:

-

Your unsecured debt has been discharged.

-

You cannot file Chapter 7 bankruptcy again for several years.

-

Your financial slate is cleaner than before.

Whether you’re in Scranton, Wilkes-Barre, the Poconos, or anywhere in Northeastern Pennsylvania, our law office has helped countless clients rebuild their credit successfully after filing.

Myth #3: “If I File Bankruptcy, I Will Lose My House, Car, and Other Property.”

The Truth:

Most people who file bankruptcy keep all of their property.

Pennsylvania residents are protected by bankruptcy exemptions that allow you to safeguard your home (up to a certain amount of equity), your vehicle, your personal belongings, and even retirement accounts. We know before filing that your assets will be protected!

At The Law Offices of Jason P. Provinzano, LLC, we carefully review your assets to ensure you understand exactly what is protected. In most cases, clients are relieved to learn that bankruptcy is designed to protect your property — not take it away.

Myth #4: “If I File Bankruptcy, It Will Be Listed in the Newspaper and Everyone Will Know.”

The Truth:

Bankruptcy filings are public record, but they are not usually published in Pennsylvania newspapers. Unless you are a high-profile individual or business, your filing is not something that will appear in local media.

Most people who file never have friends, family, or employers find out unless they choose to tell them. Your privacy is important, and bankruptcy courts do not broadcast your case.

Myth #5: “If I File Bankruptcy, It Will Negatively Impact My Job.”

The Truth:

Federal law prohibits employers from firing or discriminating against someone for filing bankruptcy. Your current employer generally won’t be notified unless wage garnishment needs to be stopped — and even then, the information is handled professionally and confidentially.

In many cases, filing bankruptcy actually improves job stability because financial stress decreases and wage garnishments end.

For employees in healthcare, education, government, transportation, and other fields in Pennsylvania, filing bankruptcy has no effect on job status or job security.

For some employees that have clearances or that have to have their clearances renewed, filing bankruptcy may actually allow for them to keep their clearances because the delinquent debt will be discharged / wiped out.

Considering Bankruptcy in Pennsylvania? We’re Here to Help.

At The Law Offices of Jason P. Provinzano, LLC, we know how stressful financial challenges can be — and how powerful a fresh start can feel. Our firm proudly serves clients across Pennsylvania, helping them understand:

-

Whether Chapter 7 or Chapter 13 bankruptcy is right for them

-

What property they can keep

-

How filing affects their credit

-

What life looks like after bankruptcy

If you’re overwhelmed by debt, misinformation shouldn’t hold you back.